Looking at our current political and economic atmospheres both here in the United States and across the world, it’s hard to ignore the fact that we seem to be approaching a recession. At the very least, a lot of us have been having a very difficult time getting back on our feet in the aftermath of the Covid 19 pandemic. While this may not seem to be that big of a deal, it has made investors start to look for some alternatives to the traditional stocks and bonds that we normally see.

Of course, doing that is a lot easier said than done, since investing isn’t really something that we can just pick up and immediately know everything about. It takes time to hone those instincts, and a lot of us would rather just be able to lean on the knowledge of others instead – it’s a lot more efficient these days. With all of that said, today we’re here to discuss precious metals.

While it might be a bit difficult to immediately jump in and start expertly investing in them, at the very least we can offer you some tips and tricks as you get started! Before we get started, here’s some background information: https://www.tandfonline.com/doi/abs/10.2469/faj.v62.n2.4085. Hopefully, that’ll help give some context as we talk about some of these concepts.

Table of Contents

Precious Metals – What are They?

Naturally, our first order of business is to discuss what precious metals actually are. Put simply, they are elements on the period table classified as “metal.” They are considered “precious” for a few reasons – most notably, the fact that they are quite rare in nature. Additionally, they are highly conductive but not corrosive, meaning that they can be utilized in electronics with little-to-no issues.

The four main ones that folks decide to invest in are platinum, palladium, gold, and silver. Obviously, though, the most popular of them is gold. It does beg the question, though – why is that?

For one thing, it’s just been the most popular precious metal for centuries. We’ve been creating jewelry, coinage, and other goods out of gold for a long time. Even after all of this time, though, it hasn’t really lost its value. While we may not operate under the “gold standard” anymore, it’s still a huge part of the investing world.

Honestly, it’s one of the metals used most often in electronics. You would be hard-pressed to find a motherboard without it, for example. This is part of why Investing In Gold can be a resource to check out, since this precious metal is one of the top choices in the eyes of many investors. That said, though, is it really worth it?

Should We Really be Investing in Gold?

Many folks worry about the fact that gold has been a type of asset for a long time. It makes a person wonder if they’re really able to hold up still after all of these years, and if there’s a chance that the market will drop off at some point. Gold is also quite easy to sell in any market conditions. While it’s certainly understandable to have these fears or worries, we’re here to assure you that this is hardly the case.

Rather, it demonstrates the longevity of precious metals in the market. There is very little that could make them fall out of favor with investors, realistically speaking. If you’ve ever heard of the concepts of “supply” and “demand” then you know why – demand for them isn’t going down, while the supply isn’t infinite.

So, it’s hard to say that they’re not worth the investment when we look at it like that. However, there are plenty of other reasons as well. A major point in favor of gold and the other precious metals in the eyes of most investors is that they can serve as a hedge against inflation. What does that mean, though?

Essentially, it means that it’s a type of asset that won’t lose value through inflation. Cash and physical currency both are hit pretty hard by inflation in comparison, as we’ve seen in the past few months. However, stocks and bonds are also impacted significantly, which is why the stock market investors get uneasy about inflation rates rising.

How Should We Invest, then?

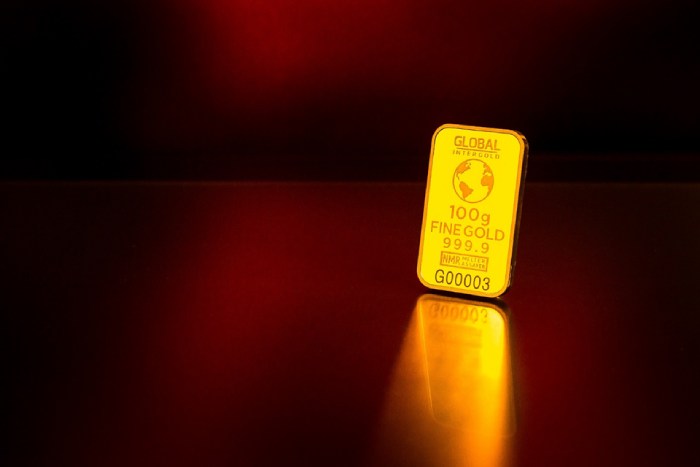

Now that we’ve covered whether or not it’s worth your while, let’s go ahead and discuss some of the methods of investing in precious metals. There’s more information on it on this page, particularly in regard to how they retain value over time. The most common (and obvious) form of investing in precious metals is to purchase bullion directly.

Typically, this is gold or silver, but some made of palladium or platinum exist. The latter two would simply be a lot more expensive for you as the investor. Either way, these bars of metal can be stored at home, with a custodian, or otherwise. They’re one of the main methods of investing in precious metals, so most advisors will recommend that you have at least some in your portfolio.

That’s another aspect of this that is important to take into account. Most of the time, when people decide to invest, they’ll end up getting an advisor of sorts to assist with the process. After all, as we mentioned, it can be somewhat difficult to get involved and invest optimally no matter what style of asset you’re interested in.

Additionally, though, these advisors and websites that offer tips can assist in tracking the market prices. Remember – often, gold and the other precious metals are considered long-term investments. Thus, you’ll likely be holding onto them for a while before deciding to liquidate. However, when you do decide to liquidate, it’s a good idea to double-check the general pricing.

So, feel free to use any of the resources that we’ve provided thus far if that’s something you’re interested in. Although it’s not overly difficult to find a broker for precious metals, finding blogs and organizations that offer reviews and recommendations may be worth checking out, to say the least!